You can record a write-off and make an adjustment by reducing the inventory account and recognizing the damaged inventory as an expense. An ecommerce chart of accounts is a structured list of all the account names that a company uses to categorize financial transactions during a specific accounting period. The chart of accounts can include an identification number and a brief description of what should be included in each account. In conclusion, a well-structured online retailer chart of accounts is indispensable for effectively managing a business’s finances as an online retailer.

- The best way to organize the accounting and bookkeeping items is to put them into a form you can understand.

- From keeping track of your daily sales to having proper records in place for tax time, managing your books should never be put on the sidelines.

- Your eCommerce accounting business process flow must be able to take into account the recurring payments and transactions.

- You’ll want to double check if you need to add new accounts or remove obsolete ones.

Accounts receivable duties are tasks that were done by hand in the past. Today, many ecommerce accounting software programs include helpful accounts receivable functions. If you run an online store, you know how important it is to keep track of your finances.

What Is the Most Common Numbering System Used for a COA?

It classifies the financial data of your ecommerce business like shipping expenses or sales from specific channels. It helps you to organize and categorize your business accounts more efficiently. If you use the double entry accounting system for your online store, you need a chart of accounts for ecommerce business use. E-commerce accounting is about managing the financial aspects of online businesses, encompassing sales, inventory, taxes, and reporting.

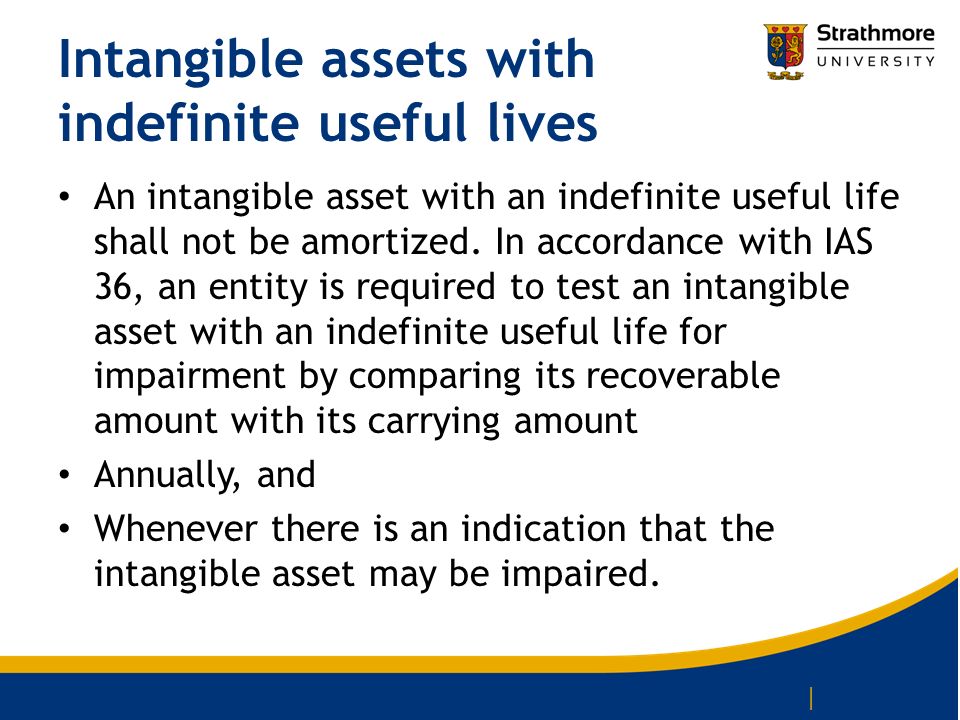

This will ensure that the chart of accounts remains relevant and effective in meeting your ecommerce business’s financial goals. A structured chart of accounts helps a business understand how actual expenses stack up against budget amounts. Ecommerce businesses can easily spot any budget deviations and further refine their financial projections. Maintaining a robust chart of accounts ensures that your ecommerce business is compliant with local and international accounting standards. Typically, the chart of accounts has five categories, which include—assets, liabilities, owner’s equity, revenue, and expenses. The accounts can further be broken down into sub-categories or sub-accounts to develop in-depth financial reports.

Then, sales and payments transactions will be automatically mapped to the corresponding sub-account. Depending on what accounting software you use, you might find that there will be default accounts and sub-accounts. Often, as an e-commerce business, you won’t need to use all the sub-accounts and/or you will need to add more. You can wave accounting tutorial do this by importing a file, using a template, or manually adding sub-accounts. When you have the right system in place for tracking payroll and payroll taxes, you can keep documents up-to-date.

Leverage accounting software

Naming your accounts is also an acceptable way to label them within your chart of accounts. You can use the business’s name, the expense type, or any other naming convention that makes the most sense for your e-commerce business. The e-commerce chart of accounts is like the command center of your e-commerce business. The creation and use of a chart of accounts are fundamental for eCommerce business owners. They can use this financial organization tool to keep track of all transactions happening within their organization. It’s important to understand that there isn’t forensic accounting skills in investigations a universal chart of accounts.

Best eCommerce Accounting Software

Ecommerce CEO is the only dedicated community for sharing real software reviews. And, since having a good amount of choices is ideal, be sure forward and futures markets to check out Webgility software accounting services, too. After reviewing the topics above, you might find that you can easily accomplish one or more of these goals on your own.

Along the way we will touch on needs specific to ecommerce businesses. With the right e-commerce accounting software, you can confidently run your online business, while also easily integrating your sales channels and platforms with your accounting software. Bookkeeping is about collecting and organizing financial transactions. A big part of that is assessing financial statements, such as the balance sheet, profit and loss statement, and cash flow statement. The balance sheet includes information about assets, liabilities, and equity, while the income statement contains everything related to revenue and expenses. These can include many sub-types, including loans, payments receivable, and product sales accounts.

With ecommerce bookkeeping, business owners or a hired bookkeeper keep track of sales, purchases, and payments. It’s also a way for you to keep an eye on business spending and profits and have records of these transactions. Vanessa Kruze, CPA, is the founder and CEO of Kruze Consulting, a leading firm specializing in financial services for startups. Her guidance has been instrumental in helping startups navigate the complexities of digital commerce, ensuring they have a solid financial foundation to support growth. Under her leadership, Kruze Consulting has been recognized as an Inc 5000 fastest-growing company for six consecutive years, a testament to her expertise in scaling businesses. A balance sheet will list assets first, liabilities second, and equity last.